What’s New for 2023? The IRS has made changes to Form 941 for the 2nd & 3rd Quarter of 2023. Learn more

2023 Deadlines for Filing Form 941

| Quarter | Reporting Period | Due Date |

|---|---|---|

| Quarter 1 | Jan, Feb, & Mar | May 01, 2023 |

| Quarter 2 | Apr, May, & Jun | July 31, 2023 |

| Quarter 3 | Jul, Aug, & Sep | October 31, 2023 |

| Quarter 4 | Oct, Nov, & Dec | January 31, 2024 |

*If the due date falls on a federal holiday or weekend, then the next business day will be the filing deadline.

Click Here to learn more about Form 941 Due Date

https://www.taxbandits.com/form-941/form-941-due-date/

Start e-filing your Form 941 now and Get Instant Approval from the IRS

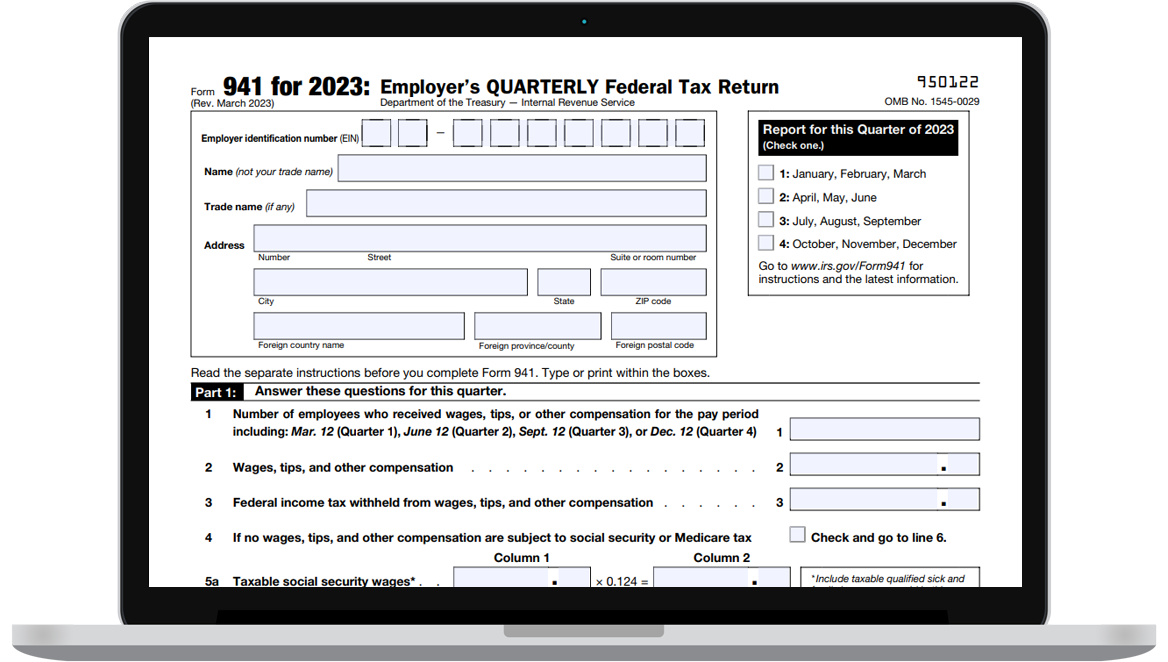

What is the Quarterly Federal Tax Form 941?

According to the law, Employers are required to report tax withholdings from their employees’ wages to the IRS. Federal income taxes, social security tax, and Medicare tax should be withheld from employees’ earnings and reported using Quarterly Form 941. You might also choose to withhold an additional Medicare tax from employees who earn more than $200,000 in a calendar year. Under the withholding tax system, taxes withheld from employees are credited to them to help them meet their tax obligations.

Visit https://www.taxbandits.com/form-941/what-is-form-941/ to learn more about IRS Form 941.

What Information Do You Need to E-file Form 941 for 2023?

Employer Details

- Name, EIN, and Address

Employment Details

- Employee Count

- Employee Wages

Taxes and Deposits

- Federal Income Taxes

- Medicare and Social Security Taxes

- Form 941 Worksheets

- Deposit Made to the IRS

- Tax Liability for the Quarter

Signing Form 941

- Signing Authority Information

- Online Signature PIN or Form 8453-EMP

Click here to learn more about Form 941 Instructions.

Steps to file Form 941 Electronically for 2023

E-File Form 941 in just 3 simple steps:

Choose the Tax year and quarter

Enter the Form 941 Information

Review and Transmit to the IRS

Visit https://www.taxbandits.com/payroll-forms/e-file-form-941-online/ to learn more about e-file 941 Form

Easily file your Quarterly Form 941 with our e-filing solution!

E-File 941 NowTaxBandits IRS E-file API Integration allows you to extend your software

The TaxBandits API is designed using the lightweight REST architecture. Our API employs HTTP requests to post any data requests. This API encodes all requests, response bodies, and error codes in JSON.

Get access to a private sandbox testing environment where you may test the application with real-world data. Using authentication keys, the API validates each request received and grants additional API access. To begin testing your API account, you will get 500 free credits for each tax form on your TaxBandits Sandbox account.

Seamlessly Integrate TaxBandits 1099 API to electronically file your 1099 return with IRS/SSA.

Check out all of the Great Benefits of E-filing your Form 941 with us

Form 941 Schedule B

Form 941 Schedule B for reporting tax liability and semiweekly deposit schedule is supported and can be e-filed with Form 941.

Zero Reporting

If you have no taxes to report for the quarter, simply select the “no payments were made” option for a shorter filing process.

Online Signature PIN

If you don’t have an Online Signature PIN, you can use Form 8453-EMP to e-file your form 941 instead.

Bulk Upload

Save time by uploading form information in bulk using our 941 bulk upload template rather than entering it manually.

Form 941 Worksheets

Auto-calculate any applicable COVID-19 tax credits for the quarter, such as the refundable and non-refundable portions of sick and family leave wages and the employee retention credit.

Form 941-V

Form 941-V is generated for you as needed for making your IRS tax payment for the quarter.

Form 941 E-filing Pricing Starts at just $5.95/form

Frequently Asked Questions on Form 941

What are the Form 941 changes for the First Quarter of 2023?

- Small businesses can now claim a $250,000 tax credit for increased research activities.

- Line 12 of Form 8974 has been updated to reflect the employer's share of social security tax.

- Line 18 now has only one option to select if you're a seasonal company and don't need to record a return for each sector of the year.

- Worksheet 1 has been updated, and Worksheet 2 has been reintroduced by the IRS.

- Forms 941-PR and 941-SS will most likely be phased out after 2023.

Visit https://www.taxbandits.com/form-941/revised-new-irs-form-941-for-q1-2023/ for more information on Revised Form 941 for 2023.

How to Avoid IRS Penalties and Interest?

If you are filing Form 941 late, then the IRS might impose a 5 percent penalty, with a maximum penalty of 25 percent. You can avoid paying penalties and interest to the IRS with help of the following instruction.

- Pay the full amount of taxes you owe when they are due.

- File your quarterly 941 Form on time.

- Accurately report your tax liability.

- Distribute accurate W-2 Forms to your employees on time.

- Accurate File Form W-3 and Copy A of Form W-2 with the SSA

Lines 11c, 13d, 13h, 13i, 21, and 22 are no longer used for reporting these tax credits, they have been ‘Reserved for Future Use’. Line 18 has also been edited, instead of having two parts (18a and 18b), Line 18 will be checked by employers to indicate that they are seasonal employers.

In addition to these updated lines, there are now only three 941 Worksheets available for employers to use for calculating COVID-19 tax credits. The social security wage base has also been updated for the first quarter of 2022, it is now $147,000.

Visit Click here to know more about the Form 941 Penalty

View More FAQ’sForm W-9: Request for Taxpayer Identification Number

and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Contact Us

Do you have additional questions about filing Form 941 online?

Connect with the TaxBandits Support Team Our team is here to help you by phone, email, and live chat